"Is it better to be feared or respected? I say, is it too much to ask for both?”

– Robert Downey Jr. as Tony Stark (Iron Man, 2008)

Tariffs, much like Tony Stark’s philosophy, are often wielded as both a shield and a sword—protecting domestic industries while also provoking economic battles. Though they may seem like a modern policy tool, tariffs have been around since the dawn of trade itself.

The earliest known tariffs date back to Ancient Mesopotamia (3,000 BCE) when city-states taxed merchants passing through their borders. The Greeks formalized customs duties as early as the 6th century BCE, and the Romans took it a step further by imposing tariffs at provincial borders.

In the United States, the Tariff Act of 1789 was one of the first laws passed by Congress, designed to generate revenue and protect fledgling American industries. Since then, tariffs have shaped—and often shaken—both the U.S. economy and global trade.

As of 2025, the U.S. Harmonized Tariff Schedule (HTS), maintained by the U.S. International Trade Commission, contains over 17,000 categories of goods subject to duties. Some of these tariffs serve strategic purposes, while others seem almost comically outdated.

For example:

- Live Foxes: A 4.8% tariff exists on importing live foxes. Why? No one really knows, but it’s been there for decades—perhaps a strategic move to protect America’s non-existent fox farms.

- Peanuts: Exceed your peanut quota, and you could be hit with tariffs as high as 163.8%.

- Corsets and Girdles: Thinking of bringing back Victorian fashion? Be prepared to pay a 23.5% tariff on corsets, proving that some outdated styles come at a premium.

- Doll vs. Action Figure Dispute: Tariffs on dolls (classified as toys that resemble humans) are 12%, while non-human action figures (like Iron Man) are taxed at 6.8%—leading to a legal debate over whether certain characters should be considered dolls or toys.

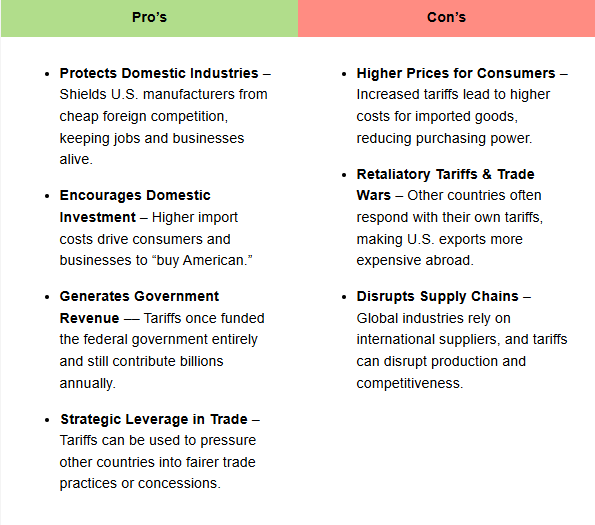

- Tariff’s have been a political and economic hot button for centuries because they come with both benefits and drawbacks

While tariffs can be damaging if overused, they can also be a powerful bargaining tool. The mere threat of tariffs has often brought foreign governments and companies to the negotiating table.

A prime example was the U.S.-China trade war (2018-2019), where the U.S. imposed heavy tariffs on Chinese goods, forcing China to agree to certain trade concessions.

Similarly, the United States-Mexico-Canada Agreement (USMCA) was finalized in 2018 after the U.S. leveraged tariffs on Mexican and Canadian goods, pushing both countries to make trade concessions. In these cases, the threat of tariffs, rather than the actual implementation, created leverage.

Tariffs have been shaping economies for thousands of years, and they remain as relevant today as they were in Ancient Mesopotamia. Whether they’re protecting American jobs, making peanut farmers happy, or deciding whether Iron Man is a doll or not, tariffs are one of the oldest economic tools in history—and they aren’t going away anytime soon.

Just like investing, trade policies require a long-term view. While tariffs can disrupt markets in the short term, they are also tools that shape economies over generations.