“Presidents don’t cause recessions, and presidents don’t cause recoveries. They can only hope to get out of the way and not hinder the economic forces at play.”

- Alan Greenspan

Let us delve into some controversial discussion this month – Politics and Presidents.

One of the more contentious elections in recent years has just ended with Donald Trump elected to the first nonconsecutive presidential term since Grover Cleveland in 1892. (1) Similarly, the Republican Party took control of the Senate, while we may not immediately know what party controls the House as the vote count continues.

In investing, emotions can run high, especially when politics are at the forefront. It is easy to get caught up in the idea that the party in power will significantly impact your investment returns.

So, I decided to do some research…

It makes sense to start this analysis in 1945, considered the Modern Era of U.S. history. This was after the Great Depression, the conclusion of WWII, and the passing of one of the highest ranked Presidents.

Franklin D. Roosevelt had just been elected to an unprecedented four terms (the 22nd Amendment of 1951 began limiting Presidents to two terms) and was credited with digging us out of the Great Depression, helping us find our way into and out of WWII, and cementing our role as a global Superpower.

For example:

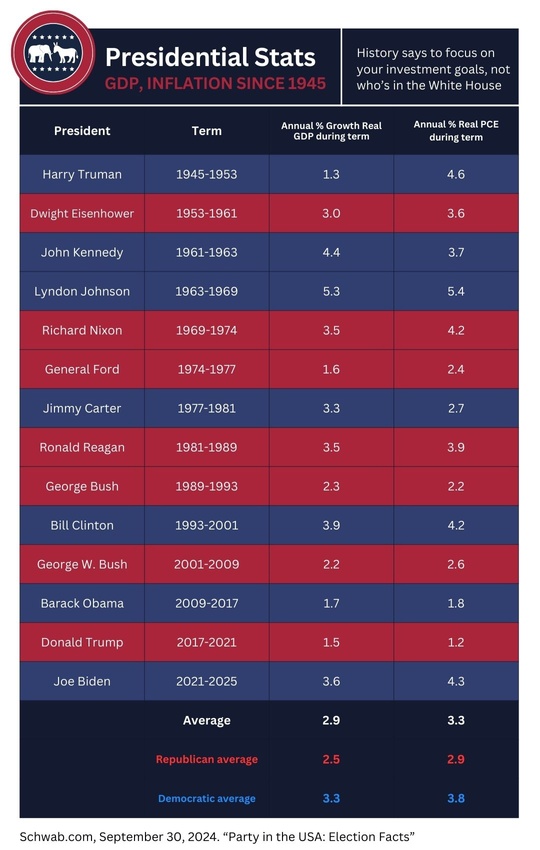

In the table below, you can see the gross domestic product (GDP) has fluctuated depending on the occupant of the White House, but it has generally trended higher over the long term. The same can be said about inflation, as shown by the Personal Consumption Expenditure price index. It has fluctuated over time but has stayed in a range over the long term

Since FDR passed and Truman took the oath of office on April 12, 1945, we have had 14 presidents. 7 Democrats, and 7 Republicans. Through the end of August 2024, there have been 19,965 trading days. A Democrat was in the Oval Office for 9879 (49.48%) of those days and a Republican for 10,086 (50.52%) days. (2)

For this analysis I assumed $1,000 was invested in the S&P 500 the day Truman took office. Presume you were 100% invested on any day that “your” party was in office and 0% invested when your party was not in office. For the Republicans, that $1,000 would have grown to just over $8,000. For Democrats that same $1,000 would have grown to over $40,000. I suspect this disparity comes as a surprise to some, but maybe not.(3)

So, that is it. It is settled. We should only invest when a Democrat is in office – right?

But wait, what if we completely ignored which party was in control of the executive branch?

If we had just stayed invested regardless, that $1,000 would have grown to over $400,000, a ten-fold improvement!

Political landscapes are ever-changing, and market reactions to political events are often unpredictable. Maybe the economy benefited or suffered from the leadership of a prior administration. A policy that might seem detrimental to the market in the short-term could have long-term benefits, and vice versa. A tax cut might provide a temporary boost to corporate profits, but without sustainable growth, the benefits may be short-lived. Also, regulations that initially seem burdensome might force innovation and efficiency gains that benefit the economy and the stock market over time.

Remaining focused on long-term goals and maintaining a diversified portfolio better positions us to weather the inevitable difficulties of the market. This allows you to participate in the growth of the economy over time, regardless of the political environment. It also helps to avoid the pitfalls of emotional decision-making, which can lead to buying high and selling low—one of the most common mistakes investors make.

It is important to remember that while presidents and parties come and go, the stock market has historically trended upward over time. This growth is driven by the collective efforts of millions of businesses, entrepreneurs, and workers who strive to create value every day. These fundamental economic drivers are far more powerful than any single political administration.

While it is natural to have concerns about how political events might impact your investments, the data clearly shows that staying the course is the most effective strategy. By sticking to an investment process through all market conditions and political climates, you are positioned to participate in the long-term growth of the market.

We remain committed to helping you achieve your long-term goals, no matter which party is in office.